As an Aussie or Kiwi retailer, you’ve undoubtedly heard of buy now, pay later (BNPL). Although not perfect for every consumer, BNPL gives customers a hassle-free way of paying for your goods — whether in-store or online.

If you’re wondering if you should offer BNPL to your customers, this article is for you. We’ll give you vital info and stats and tell you how to set up this lucrative payment option in your stores.

Buy now, pay later options are extremely popular — particularly in Australia. Recent research by Mambu has revealed that Australians have the highest uptake of Buy Now Pay Later (BNPL) services globally. As of November 2021, 24 % of Aussies have used BNPL compared to just 11% of people worldwide.

According to Roy Morgan, “16 million Australians aged 14+ (75.5%)are now aware of buy-now-pay-later services such as Afterpay, Zip, Latitude Pay, Humm and Openpay.”

What is buy now, pay later?

Buy now, pay later is pretty much how it sounds. The customer can buy their goods immediately (after a down payment of approximately 25%) and then pay off the goods later. The ‘later’ bit means that the customer usually pays off the goods over 4 instalments. It’s a service that offers instant gratification with the added advantage of delayed payment.

BNPL is particularly popular because there’s no interest and no late fees, unlike credit cards. And — there’s little to no credit checks. Providing the consumer use the service responsibly, it can be extremely beneficial.

Conditions do vary, though, and some service providers charge fees if there are additional payment instalments or the customer renegotiates the plan.

Why is buy now, pay later so popular?

BNPL has become popular through a confluence of events — and Millennials have led the trend approximately five years ago. Initially, the service was only available online. Covid fueled the flames (with customers everywhere stuck in isolation) along with the economic hardships it brought to the table.

Buy now, pay later options were a perfect solution when people needed to keep their savings and cash flow in check. The ability to pay off your item slowly without incurring interest was terrific; word spread and BNPL took off. When it became available in-store and not just online, its popularity soared further.

After Millennials, Gen X has been the biggest driver of BNPL, followed by Gen Z. But no matter their demographic, all customers have enjoyed the convenience and ability to keep saving while not incurring interest.

Due to its online popularity, BNPL was later introduced to brick-and-mortar stores, where it especially took off in the fashion industry. Additionally, certain professional services like dentistry and even travel have now embraced the trend. BNPL also appeals to those not eligible for or who don’t want credit cards (and the painful sting of interest rates attached). It’s also great for people not interested in finance contracts often offered by retailers selling white goods and large household appliances.

How does BNPL benefit retailers?

Retailers of any size can enjoy a handful of benefits of buy now, pay later, whether you’re selling online or in-store:

- Increase your conversions — BNPL payment solutions give shoppers the ideal opportunity to purchase something they would have otherwise walked away from.

- Increase your transaction/order value — Access to credit means customers are prepared to spend more on what they want. This can increase their average order by up to 18%, according to Afterpay (citing research by MasterCard AU)

- Grow your customer base — By opening new payment channels, retailers can encourage new audiences to shop.

- Enjoy repeat sales — BNPL builds relationships with customers who, statistically speaking, keep coming back for more. 90% of Afterpay’s transactions are from returning customers who shop using Afterpay at least 9 times a year.

- Fewer abandoned online purchases — about 75% of all shopping carts are abandoned before purchase. BNPL improves these conversion rates.

- Minimise risk and fraud — BNPL payment solutions manage all fraud and credit risk to scale your business with less risk and less worry.

Setting up BNPL online or in-store is easy. But life gets easier again if you integrate your sales and accounting data from all channels into one POS system like Retail Express. To find out more, get a free demo with Retail Express today.

How does BNPL enhance the customer experience?

Providing a retailer target the appropriate consumer, BNPL payment options help drive a more enjoyable and seamless customer experience. Here’s why:

- It fuels the customer’s need for instant gratification — With an increase in choice, shoppers can use BNPL to take home the items they want immediately without digging deep into their savings.

- It offers a seamless shopping journey — Shoppers don’t have to miss out, or awkwardly discover they don’t have enough money for their items at checkout.

- It allows controlled spending — The worry of receiving a surprise bill (enhanced with alarming interest) at the end of the month is gone — it’s one of the strong attractions of BNPL over credit cards.

- There are no or lower fees — most BNPL services charge zero or lower interest fees, making them an attractive option over the major credit cards.

As with any service, retailers must assess whether their customer base could misuse it. Low-income earners, the unemployed or disadvantaged, and young adults can quickly fall down a rabbit hole of debt by overusing the payment method. Additionally, if individuals fail to meet their BNPL arrangement, this can negatively affect their credit score.

When interviewed by Choice magazine, Zack Wildly, a financial counsellor at the Indigenous Consumer Assistance Network based in Cairns, said, "Nine out of ten customers might use BNPL effectively and healthily, but then there is that one person you see who is in real trouble".

While the onus always lies on the individual to make their financial choices, it is not unfair to suggest that retailers assess their customers’ ability to make repayments.

How does buy now, pay later work in retail?

Although there may be slight variances between providers, BNPL is pretty straightforward. Here’s how it works:

BNPL in eCommerce

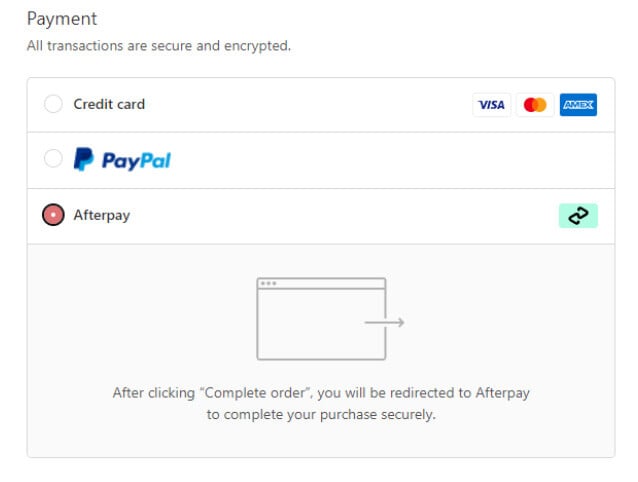

- The online customer navigates to the checkout with their goods and starts the checkout process as usual (filling in their details)

- When they select payment options, they simply choose the BNPL option, e.g., Afterpay

- Once they’ve completed checkout, they’re directed to the BNPL site for a quick eligibility check (if required)

- They pay a down payment and agree to pay for the purchase in four or more instalments

- The retailer sends the customer their goods

- The BNPL provider pays the retailer in full, usually within three days

BNPL in-store

The same process occurs in-store with a couple of minor differences:

- Your customer opens their ZIP Pay app at the cashier

- A bar code is generated on their app

- Your staff scan the barcode and processes the transaction in Retail Express

- Your customer takes home the goods, adhering to their agreed payment plan with ZIP Pay

- You, the retailer, get paid in full by ZIP within a few days

How do I offer buy now, pay later to my retail customers?

Organising buy now, pay later for your retail business is straightforward. After choosing a provider, you’ll need to be approved by them. Once approved, you can integrate the payment service into your eCommerce site or retail store POS system.

If you have omnichannel POS software in place, BNPL sales data from all channels will integrate into one set of data. Retail Express, for example, partners with Afterpay and Zip Pay. Suppose you have applied to Afterpay and been approved. In that case, you can easily go into your settings, then integrations, and choose Afterpay. Follow a few more prompts, and you’re good to go.

Are there any BNPL fees?

Some providers, such as Afterpay, don’t charge set-up fees. But others do, so it’s worth shopping around first.

BNPL companies do charge a fee for the service, though. Usually, it’s a percentage fee of around 6% plus a small transaction fee of about 30 cents.

The BNPL fees may be slightly higher than credit card fees, but here’s the thing. Although you may have to pay a little more per transaction, you will be processing a lot more transactions.

Afterpay, for example, boasts a 2x conversion rate and up to 9.8% lift in sales. And they state that 57% of customers would switch to a business that offers Afterpay.

Anything you can do to increase conversions and sales in a highly competitive retail climate is worth investigating. And as buy now, pay later options have been proven repeatedly to increase revenue, it may be time for you to get in on the act.

What are buy now, pay later apps?

A buy now, pay later app is a downloadable program designed to use on your mobile phone. For example, suppose customers have joined ZIP Pay. In that case, they can download the ZIP Pay app from either Google Play or the App Store.

To buy goods from a store offering Afterpay, apps are no longer used. Instead, they use a card. However with ZIP Pay, they open the app and tap to make a purchase.

The ZIP Pay app also shows personal recommendations to customers, so your retail brand will get extra exposure — and potentially more sales.

Preparing for BNPL: a checklist

It never hurts to plan and prepare like a Boy Scout before starting any new business project. Here are a few things to quickly think through:

Is the BNPL provider appropriate for your product?

Some providers are best suited to large household items. In contrast, others are appropriate for far smaller items — even cheaper make-up items or socks. Check that the provider is right for your brand.

Are there payment terms reasonable for your customer?

Providing you go with a reputable provider, this shouldn’t be a problem. At Retail Express, we offer two highly respected providers — Afterpay and Zip Pay. Afterpay allows customers to pay their debt in four instalments over six weeks — interest-free. Zip Pay is also interest-free and enables the customer to pay their bill weekly, fortnightly or monthly as long as they cover the agreed minimum monthly repayments. With Zip Pay, customers must pay a $7.95 monthly account fee, but this is waived if they pay off their balance by the due date.

Set up fees and additional charges

Both Afterpay and Zip Pay don’t charge a set-up fee for merchants. However, others do, so do your homework. Afterpay charges $0.30 plus around 4 to 6% of the cost of goods for every transaction.

Do I have the software to integrate a BNPL service into my store?

You can add a buy now, pay later service to your in-store POS machine quite easily. Likewise, you can add it to most eCommerce platforms. However, if you have good omnichannel POS software, you can integrate the data from all channels so you can clearly see all accounting and reports in one place.

How to promote buy now, pay later online & in-store

Promoting your buy now, pay later services is a recipe for success because BNPL adopters actively seek brands that offer it.

Advertise the service wherever you provide the service — on your website, in-store or both. Most providers offer merchants a Retailer Kit or Merchant Resource pack that you can download. This gives you all the required promotional information, such as logos, marketing assets (e.g., social media imagery and artwork), QR codes, tips and guidelines.

Next steps

Adding a buy now, pay later option to your retail business is an excellent way of offering more customer convenience. And it helps increase revenue effortlessly in several ways. Here’s what you can look forward to:

- Increase conversions

- Increase your order value

- Grow your customer base

- Enjoy repeat sales

- Have fewer abandoned online purchases

- Minimise risk and fraud

And your customers will love it, too:

- Fuels the customer’s need for instant gratification

- Offers a seamless shopping journey – no missing out, discovering they don’t have enough cash

- Allows controlled spending

- No or lower fees

Setting up BNPL online or in-store is easy. But life gets easier again if you integrate your sales and accounting data from all channels into one POS system like Retail Express. To find out more, get a free demo with Retail Express today.

Buy now, pay later FAQs

What are the top buy now, pay later companies

There is a handful of companies offering buy now, pay later services. The top players are Afterpay, Zip Pay, OpenPay, Payright, Humm, Laybuy, Splitit, Sezzle, Klarna, Paypal, LimePay, Brighte and Art Money.

What are the top buy now, pay later companies

There is a handful of companies offering buy now, pay later services. The top players are Afterpay, Zip Pay, OpenPay, Payright, Humm, Laybuy, Splitit, Sezzle, Klarna, Paypal, LimePay, Brighte and Art Money.

What are the best buy now, pay later apps

When searching for the best buy now, pay later app for your business, look for a provider that offers ease of use for customers, no account-keeping fees and is well-known and available in plenty of popular stores. Also, they should prioritise the customers the number of repayments that purchases are split.

How do I add buy now, pay later on Shopify

If you have an eCommerce store on Shopify, adding a BNPL service is easy. Adding BNPL is also possible with other eCommerce platforms like WooCommerce, Magento or BigCommerce. First, you must apply with a provider and get approval. Then you simply go to the POS settings and follow the prompts. However, if you also want to offer this service at your have a physical store/s, we recommend you have good POS software in place. This way your sales data from all channels are integrated into the one central system.

How does buy now, pay later benefit the merchant?

Buy now, pay later services work for the merchant in several ways. They help increase conversions, increase your order value, grow your customer base, encourage repeat sales and minimise risk and fraud. Additionally, good BNPL services advertise their retail clients on the website, potentially driving more traffic and more sales for your business.

How big is the buy now, pay later market in Australia?

Nearly 75% of Australians were aware of buy now, pay later options in early 2021, according to a survey by market and consumer data company Statistica. 70% of consumers surveyed were aware of Afterpay, while 50% were aware of Zip. According to Afterpay, 3.6 million Australian customers shop with Afterpay. According to a 2020 article by ABC News, Afterpay and Zip combined have about 5.4 million customers in Australia.

How big is the buy now, pay later market in New Zealand?

New Zealanders spend $887 million using buy now, pay later services, reported NZ news platform Stuff in February 2022.

How do buy now, pay later providers make money?

Buy now, pay later providers mostly make money by the transaction fee they charge merchants and overdue (late) fees to customers who don’t pay their debts on time. Additionally, some BNPL companies charge interest.

Should my store add buy now, pay later?

Adding another payment method to your physical or online store adds convenience for your customers — and customers love convenience. Also, as BNPL does not charge interest to the customer, it’s an attractive option for those on a budget or being careful with savings.

Buy now, pay later options are also incredibly popular; many Aussies and Kiwis have a BNPL account and look for merchants who offer this payment method. Statistically speaking, BNPL offers merchants considerable rewards. They help increase conversions, order value, and customer base. They encourage repeat sales and minimise risk and fraud.

Good BNPL services also advertise their retail clients on their website, potentially driving more traffic and more sales for your business.

Are there buy now, pay later alternatives?

Buy now, pay later is a convenient payment option, but it is not the only payment option available. However, it is relatively unique in its offerings. Decades earlier, we had a similar option — layby (or layaway). But with layby, the customer couldn’t receive the goods until they completely paid off the item.

The most common option similar to BNPL is credit cards. Similar to BNPL, the customer receives the goods immediately, and the repayment has nothing to do with the merchant. However, credit cards come burdened with high-interest rates — which some customers struggle to cope with.

Over half of Australians prefer to use BNPL over credit cards, according to Aussie retail industry reporting company Retailbiz. BNPL gives customers immediate gratification while helping to maintain control of their budgets and debt. Although, any payment service can be abused and customers can find themselves in financial trouble with buy now, pay later services if they don’t control their spending.

Who owns Afterpay?

Afterpay was acquired by philanthropist, Internet entrepreneur and Twitter co-founder Jack Dorsey’s company Square in 2021. Afterpay was founded by Australians Nick Molnar and Anthony Eisen in 2014.